India leads digital asset adoption, Southern Asia dominates

India is the world leader in digital asset adoption, maintaining its position atop the global rankings for the second year in a row, a new report by Chainalysis has revealed.

The 2024 Global Adoption Index report revealed that digital asset activity had increased substantially last year, eclipsing the 2021 ‘crypto’ bull market levels as the sector continues to expand beyond pure speculation.

In its annual report last year, Chainalysis found adoption to be driven primarily by developing economies, with countries like Vietnam, Nigeria and Thailand ranking highly. This year, adoption was across the board, although high-income nations focused mainly on speculation while the developing nations explored other use cases like payments and decentralized finance (DeFi).

India leads the pack, again

For the second consecutive year, India is the world’s largest digital asset market. The South Asian nation also ranked first for centralized service value and retail trading volume.

India’s domination is a testament to the resilience of the country’s digital asset faithful, who have had to brave exchange crackdowns, central bank restrictions and high tax deductible at source (TDS).

Eric Jardine, the research lead at Chainalysis, believes that Indians have been quick to adapt to the ever-changing conditions, enabling them to maintain a strong presence in digital assets even when the conditions weren’t as conducive.

“India has also got a fairly widespread level of adoption across different assets of crypto despite restrictions, implying new participants to crypto would have been participating via services that were not banned,” Jardine commented.

This year, the Indian government has started rolling back some of the restrictions. Earlier this month, for instance, the Financial Intelligence Unit (FIU) revealed it intends to license two offshore exchanges early next year after shutting them all down earlier this year.

Jardine believes this shifting stance “is probably just going to amplify adoption in the country.”

For a country with over 1.4 billion residents, India’s digital asset needs would stretch most blockchain networks to the limits. Currently, these needs have been limited to speculation on exchanges, but as more developers build decentralized applications (dApps) that solve real challenges, such as payments and supply chain management, only a network that scales unbounded can handle the sheer amount of volume that India will generate.

BSV remains the only blockchain capable of handling enterprise-grade applications that cater to millions of users. With the Teranode upgrade this year, BSV can handle over a million transactions per second (TPS), while still maintaining negligible fees.

India has embraced BSV, with Timechain Labs leading the charge. The Hyderabad-based company has been championing developer training and education and funneling talent into the BSV space while also developing its own blockchain-based solutions, such as the supply chain financing platform DeepFinance.

Central and Southern Asia lead in adoption

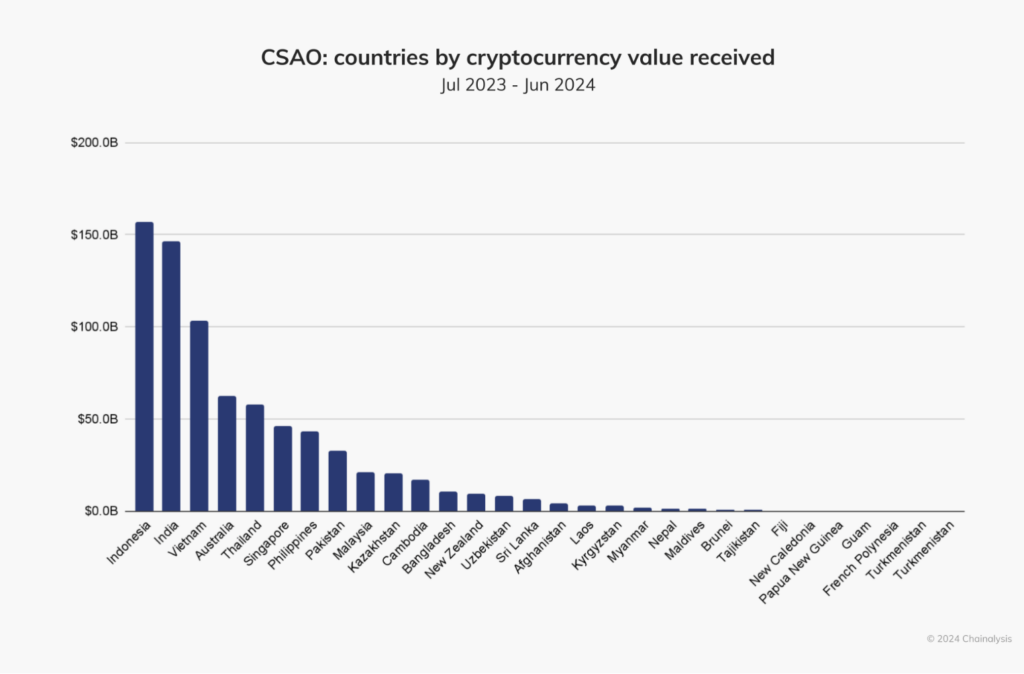

While India was the overall leader, the entire Central & Southern Asian and Oceania (CSAO) region has recorded high digital currency adoption in the past year.

Indonesia ranked third globally for adoption and first for DeFi, and was joined in the top ten by Vietnam, the Philippines and Pakistan.

Chainalysis revealed that CSAO received $750 billion in digital assets in the year ending June 2024, accounting for 16.6% of the global value to rank only behind North America and Western Europe.

Indonesia was the biggest player in CSAO, receiving $157 billion in that period to edge out India and Vietnam.

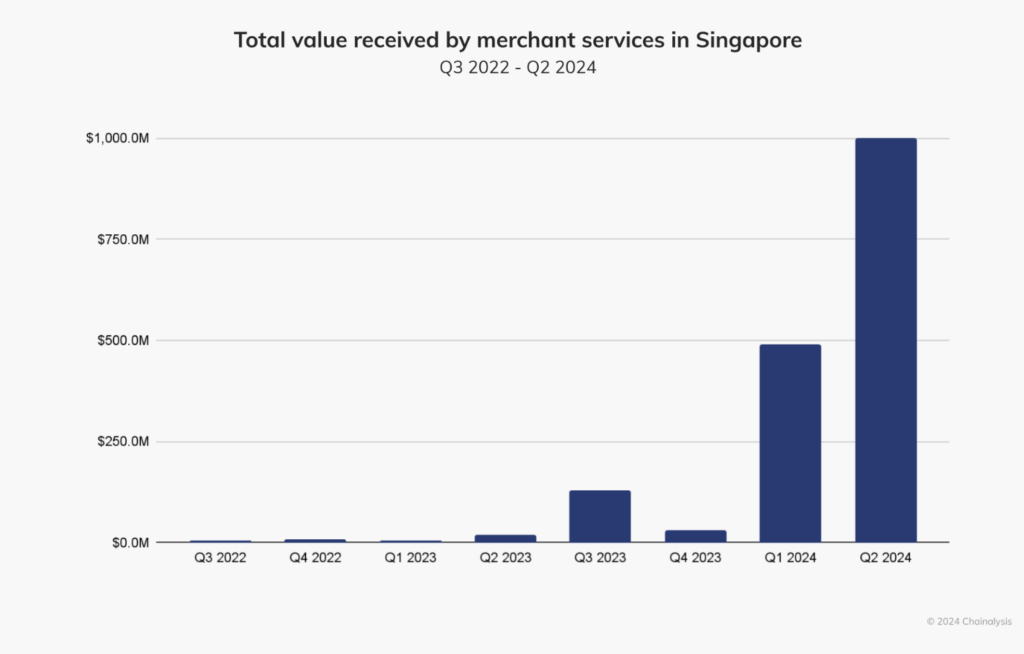

While Indonesia and India grab the headlines, Singapore might quietly be the country where digital assets are making the biggest impact. The city-state recorded the highest concentration of digital asset payments, with local startups like dtcpay leading the charge. However, the entry of giants like the Grab super-app, which now allows users to top up and pay with digital assets, has given the sector a massive boost.

In Q2 this year, Singaporean merchants received over $1 billion in digital asset payments, setting a new record.

Singapore is one of the world’s most developed economies and has an efficient payment system, with only 1% of payments done in cash. This proves that digital asset payments are moving from being an alternative for the marginalized in developing economies to becoming a viable alternative even where cards and mobile payments are ubiquitous.

A key advantage digital assets have over legacy systems is their ability to facilitate micropayments. While Visa (NASDAQ: V), Mastercard (NASDAQ: MA) and localized banking systems may be efficient for sizable payments, they are disproportionately expensive for micropayments.

However, not all blockchains were created equal, especially for micropayments. These only work if the underlying network has negligible fees and scales for enterprise needs. Only BSV can facilitate micropayments seamlessly; already, there’s a thriving ecosystem of dApps whose business models are based on allowing micropayments in the BSV space, and they are solving challenges such as social media bots, Internet of Things security and spam.

Watch: India is going to be the frontrunner in digitalization